Enhance and

automate your loan

underwriting process

TaskSuite's cloud-based Credit AI Platform simplifies and

automates loan applications, offering robust fraud

protection and seamless integration with credit bureaus

for credit scoring.

Increased Volume & Scalability

Credit AI's automated underwriting can easily handle high volumes of loan applications, making it ideal for lenders looking to scale operations.

Greater Application Data Accuracy

Automated underwriting minimizes errors and ensures consistent application of credit criteria, improving loan approval accuracy.

Enhanced Customer Experience

Automated underwriting provides a seamless and efficient loan application process, delivering a faster and better customer experience.

Advanced Workflow Efficiency

Credit AI's underwriting process saves time and eliminates manual errors, enabling faster processing and approval times and unlocking cost savings.

Improved Risk Management

Credit AI analyzes vast amounts of data

to determine the risk level of each

loan application, allowing lenders to make

more informed decisions.

Credit Scoring Integration

Integration with credit bureaus for quick and accurate credit scoring

Seamlessly integrate for rapid, precise credit scoring, empowering informed decisions and streamlined loan processing.

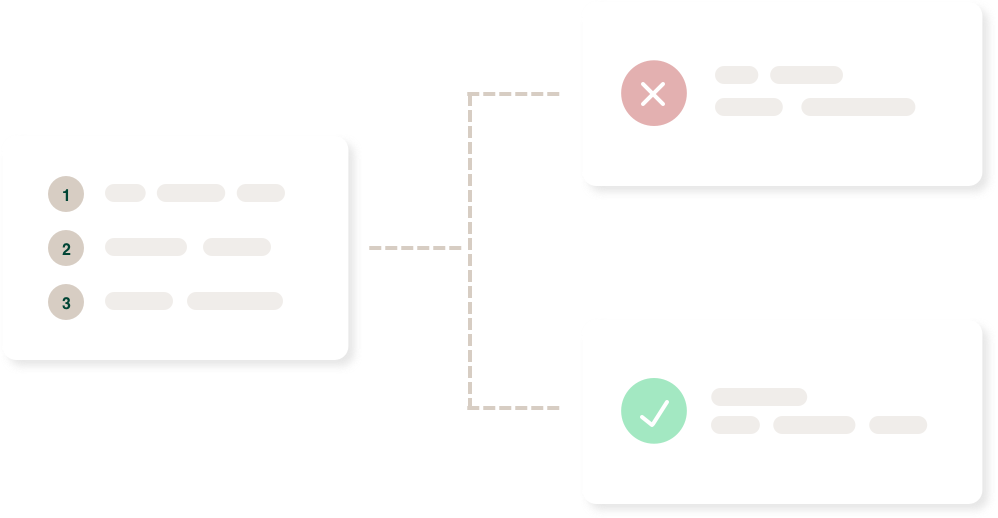

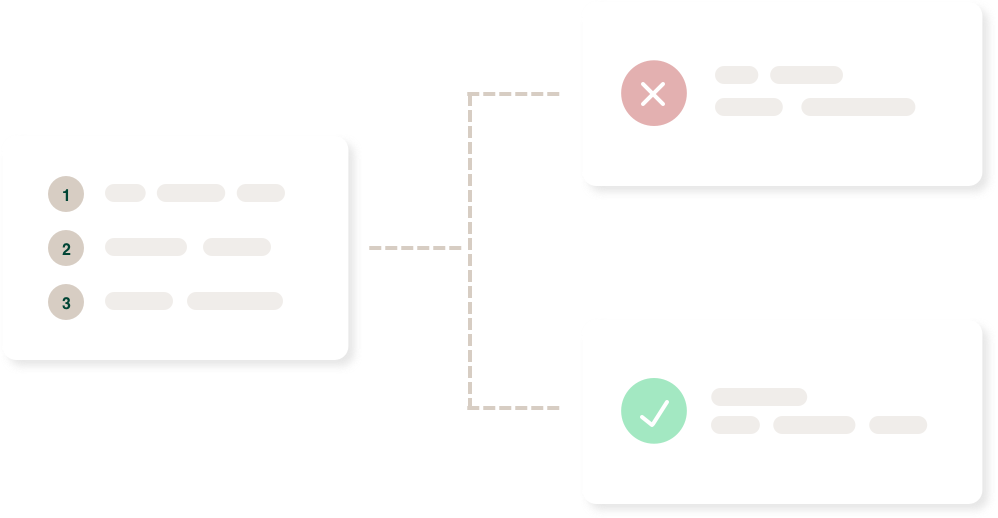

Automatic Decision Making

Automatically make loan decisions based on predefined criteria and risk assessments

Enhance decision accuracy and efficient risk assessment through our rapid, tailored underwriting solution.

Document Scanning

Scan and verify important loan application documents, such as income or bank statements

Automatically scan and authenticate crucial laon documents for a reliable and expedited application process.

Cutomizable Rules Engine

Set custom underwriting rules and criteria to meet your businesses specific needs

Tailor your underwriting experience with our Customizable Rules Engine, designed to adapt to your business's unique requirements and standards

Included features

Everything you need, in one place.

Robust Fraud Detection

Integrate with fraud detection tools to identify and prevent fraudulent loan applications.

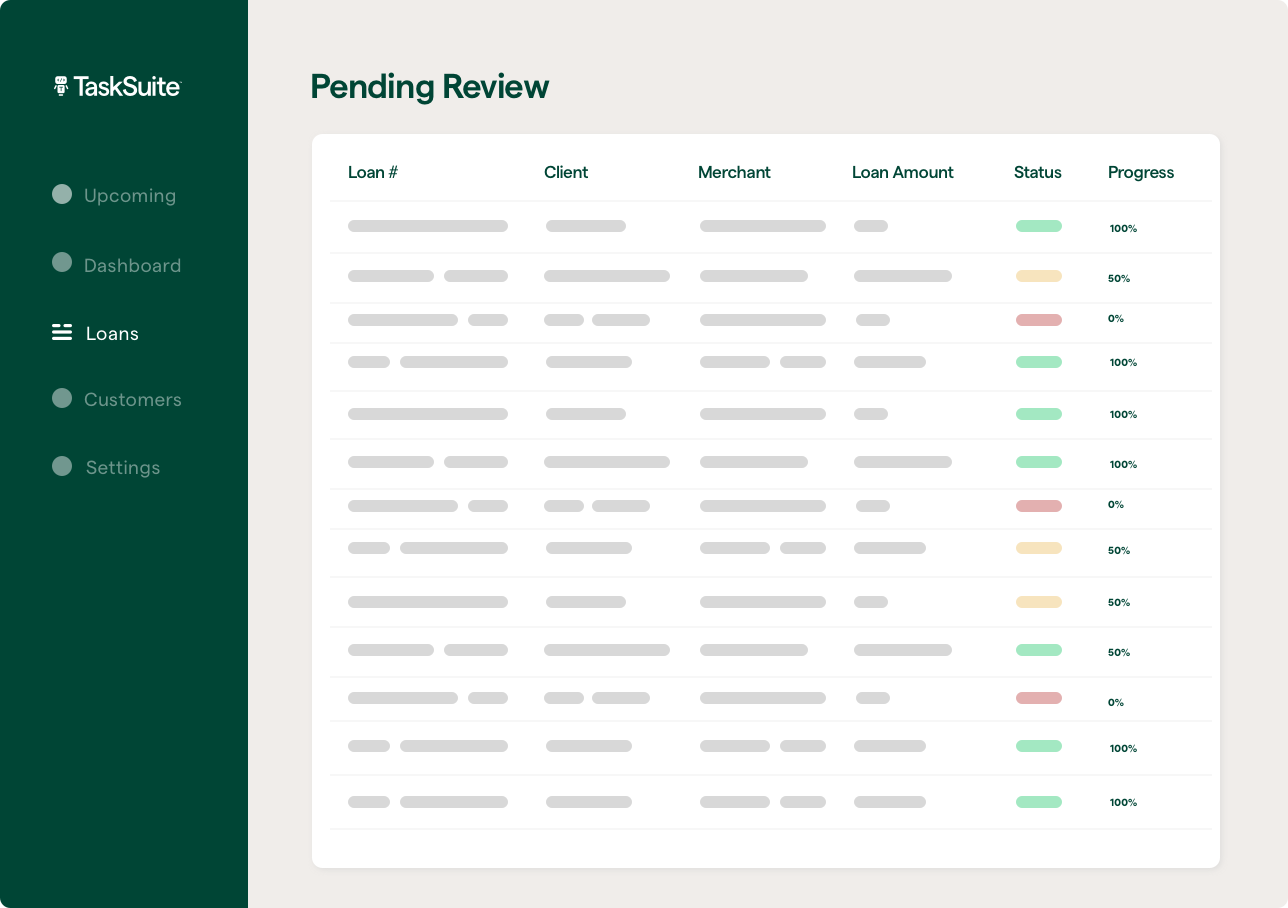

Reporting & Analytics

Access to real-time reports and analytics to track loan processing times, approval rates, and other key metrics.

User-Friendly Interface

A user-friendly interface for lenders and underwriters to manage loan applications and make decisions.

Stronger, together.

TaskSuite's Loan Credit AI tool is even more powerful when utilized alongside our

full suite. Our all-in-one platform puts the control at your fingertips.

ORIGINATION

Online applications,

documents, credit checks,

verification, and more.

CREDIT AI

Seamless integration with

credit bureaus for scoring

and fraud protection.

SERVICING

Cloud-based loan support

for reducing risk and

centralinzaing your portfolio.

MANAGEMENT

Automated loan

application processing,

tracking and reporting.

Get a TaskSuite demo

Discover simpler & faster workflows

Experience revolutionary technology firsthand

Discover customizable & adaptable solutions