Report and support

your loan portfolios,

all in one place

TaskSuite's Loan Servicing Suite is a cloud-based digital

platform designed to improve loan portfolio management.

The most comprehensive solution on the market, the Loan

Servicing Suite helps to reduce risk, provide better

tracking, and improve customer service.

Increase Team Efficiency

Automated processes, streamlined workflows, and real-time reporting improves the efficiency and accuracy of business.

Better Customer Experience

White-labeled Online Borrower Portal and omni-channel communication enhances the borrower experience.

Enhanced Risk & Fraud Protection

Advanced reporting, compliance monitoring, and fraud detection tools can help reduce risk and minimize potential losses.

Improved Risk Management

Centralized data storage and reporting provides a comprehensive loan portfolio view and enables improved decisions.

Boost Productivity & Reduce Costs

Automated loan servicing

processes can free up staff time,

allowing focus on higher-value

tasks and leading to cost savings.

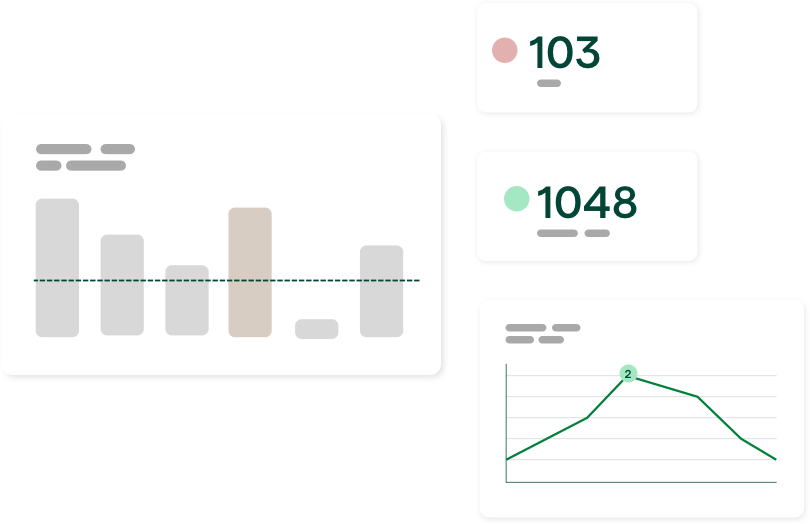

Loan Stats

Ability to manage and track loan payments, balances, and default status

Easily track and manage your loans ensuring streamlined oversight and optimized portfolios.

Customizable Dashboards

View loan portfolio information and track performance

Create personalized dashboards to visualize loan portfolio data and monitor performance, improving your lending strategy with ease.

Automated Workflows

Automated processes for tasks such as payment processing and late fee calculation

Modernize operations with Automated Workflows, boosting productivity and accuracy.

Online Borrower Portal

Secure white-labeled platform for borrowers to access loan information

Empower your clients to effortlessly access loan details, make payments, and apply for new loans, all with in a seamless branded experience.

Included features

Everything you need, in one place.

Omnichannel Communication

Options for email, SMS, and voice communication with borrowers to provide a convenient customer experience.

Reporting & Analytics

Advanced reporting and analytics capabilities to gain insights into loan performance and identify areas for improvement.

Compliance Monitoring

Tools to ensure compliance with industry regulations and standards

Fraud Detection

Advanced fraud detection capabilites to minimize potential losses.

Data Security

Secure data storage and protection of sensitive information.

Integration with Other Systems

Ability to integrate with other systems such as accounting software, payment processors, and credit bureaus.

Stronger, together.

TaskSuite's Loan Servicing tool is even more powerful when utilized alongside our

full suite. Our all-in-one platform puts the control at your fingertips.

ORIGINATION

Online applications,

documents, credit checks,

verification, and more.

CREDIT AI

Seamless integration with

credit bureaus for scoring

and fraud protection.

SERVICING

Cloud-based loan support

for reducing risk and

centralinzaing your portfolio.

MANAGEMENT

Automated loan

application processing,

tracking and reporting.

Get a TaskSuite demo

Discover simpler & faster workflows

Experience revolutionary technology firsthand

Discover customizable & adaptable solutions